Ibukun Oguntola and Dabri Ohanu Olohije (Lead Writers)

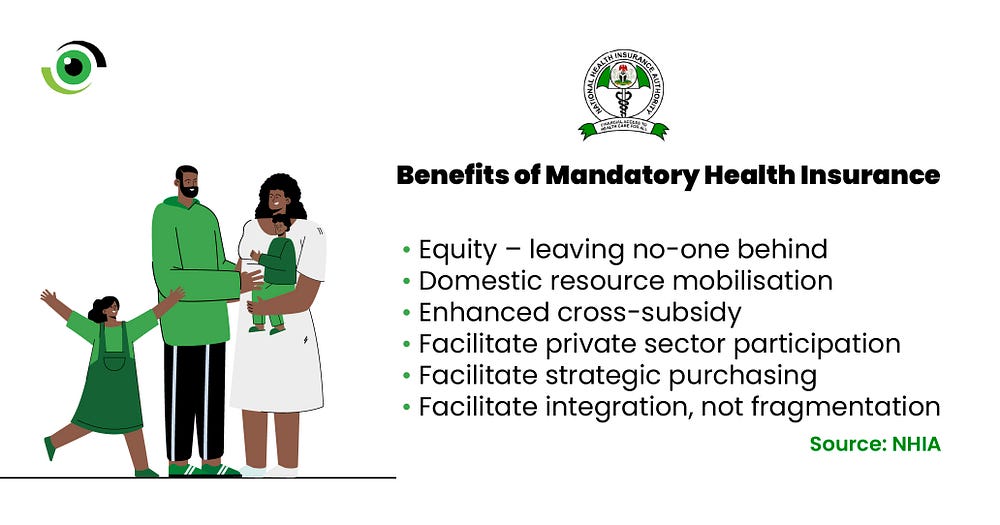

The enactment of the National Health Insurance Authority (NHIA) Act in May 2022 has been lauded as a giant step towards addressing barriers to the achievement of Universal Health Coverage (UHC). Aimed at bridging the gaps in the NHIS legislation, which it replaced, the Act also makes health insurance mandatory for every Nigerian and legal resident and authorises the NHIA to improve and leverage private sector participation in the provision of healthcare services.

Implementing the NHIA Act

The NHIA is taking steps to ensure the proper implementation of the Act by developing strategies and roadmaps for its implementation. Committees have been set up for the ‘Development of Operational Guidelines’ and ‘Innovative Financing’. Notably, on the 28th of March, 2023, the committee on Mandatory Health Insurance was inaugurated. Advocacy for financing the Vulnerable Group Fund (VGF) has also commenced.

However, the successful implementation of the NHIA Act requires a collaborative effort from all stakeholders: the government, healthcare providers, insurance companies, and the general public. Therefore, as planning for the implementation of the Act continues, it is imperative to involve these stakeholders in a discussion to foster understanding, increase awareness and sustain interest.

Accelerating implementation of the NHIA Act

For this reason, stakeholders convened at the 2023 Health Financing consultative forum, themed “Accelerating the Implementation of the National Health Insurance Act to Improve Health Insurance Coverage in Nigeria,” to discuss the challenges and opportunities in implementing the NHIA Act and to develop strategies to accelerate its implementation.

Opening the forum, Vivianne Ihekweazu, Managing Director, Nigeria Health Watch said, the operationalisation of the NHIA provides an invaluable opportunity for the achievement of UHC, adding that, “the operationalisation of the NHIA is a critical step towards reducing catastrophic out-of-pocket expenditure and achieving UHC in Nigeria… I hope this health financing dialogue will serve as a catalyst for accelerating and implementing the NHIA Act and provide an avenue for constructive dialogue and collaboration between all the various stakeholders who need to be part of the successful implementation.” She went on to add that the successful implementation of health insurance “hinges on effective communications to relevant stakeholders, especially the public who need to understand the benefits of having health insurance”.

In his keynote address, Professor Mohammed Nasir Sambo, Director General, National Health Insurance Authority, stressed the importance of financing in the health system and its relationship to socio-economic development. Professor Sambo added that in a world of competing needs and limited resources, innovative financing for health insurance is key to adequate implementation of the NHIA Act. “We cannot finance health insurance without thinking about innovative ways outside the traditional ways we are used to. We must develop relevant policies & make efficient use of available resources to ensure equitable access to basic healthcare services that leave no one behind,” he said.

Discussing the need for ‘Innovative health financing mechanisms for the Vulnerable Group Fund’, Mr Ben Akabueze, Director General, Budget Office of the Federation, corroborated the need for alternative financing mechanisms for health care as a mechanism for financing a strong health insurance system. Mr Akabueze emphasised that innovative financing mechanisms should focus on generating funds and improving the healthcare system’s efficiency. “Despite continuing efforts to rationalise public expenditures, we must keep our eyes on value for money; if we don’t, we will lose public enthusiasm. Hence there must be accountability and transparency in implementing health insurance.”

Presenting the results of a 2022 survey conducted by NOIPolls, Dr. Chike Nwangwu, the CEO of NOIPolls Limited, highlighted the pressing need for interventions within the Nigerian healthcare system to alleviate the burden of out-of-pocket health expenses. Shedding light on the survey findings, he pointed out the necessity for a clear and purposeful strategy to facilitate the widespread enrollment of Nigerians in health insurance schemes by engaging relevant stakeholders. Additionally, he elaborated on the importance of conducting extensive community sensitisation efforts to enhance the uptake of health insurance among the population.

Another crucial strategy emphasised was the strategic purchasing of health services to drive the achievement of Universal Health Coverage (UHC) in Nigeria. According to Dr. Hope Uweja, the Country Director for Results for Development, strategic purchasing involves making purposeful decisions regarding the allocation of pooled funds. These decisions encompass determining which services to prioritise, selecting the appropriate providers, and establishing the payment mechanisms based on predetermined objectives, priorities, and informed insights. “The health budget is the cornerstone of financing for Universal Health Coverage and needs to be leveraged to improve equity and efficiency through strategic purchasing,” He added.

Exploring Strategies for Expanding Mandatory Health Insurance Coverage to the “Missing Middle” in Nigeria

Health insurance mechanisms for the formal sector have been comparatively less challenging to establish because of their structured and predictable nature. However, capturing workers in the informal sector has been a challenge. Expanding health insurance coverage to this group is critical for achieving universal health coverage in Nigeria.

In the first panel discussion, the panellists, who represented various informal sector groups, discussed pertinent issues related to the existing barriers to accessing health insurance within their respective groups. They also suggested potential strategies to enhance enrollment within these groups.

A critical challenge identified was the lack of awareness in communities. According to His Royal Highness, Professor Jetta Bawa Sanwolo, the Esu of Jikwoyi, “Sensitisation is critical in improving people’s perception of health insurance in Nigeria. Beyond this meeting, we must take this message to the grassroots level to sensitise them on the importance of health insurance”. He, alongside other panellists, emphasised the importance of community ownership and building community trust towards health insurance buy-in.

However, to bridge the gaps identified, inclusion should be central to ensure that no one is left behind. According to Hellen Beyioku-Alase, Executive Director, Deaf Women Aloud Initiative, “By actively involving persons living with disabilities in the design and implementation of health insurance schemes, we can ensure that their specific requirements are met and that they receive adequate financial protection and access to essential health services”.

Understanding the Roles and Responsibilities of Different Stakeholders in the Implementation of the NHIA Act

The undefined roles and relationships of stakeholders was identified as one of the many challenges that hampered the NHIA Act’s successful implementation. Therefore, the second panel examined the roles and responsibilities of the different stakeholders and their contributions towards achieving the goal of providing affordable and accessible healthcare to all Nigerians.

Understanding the roles and responsibilities of each stakeholder can help identify potential gaps or areas of overlap and facilitate better collaboration and coordination among stakeholders. “Collaborative efforts and coordination among the different stakeholders in the health insurance ecosystem are essential for the successful implementation of this act,” emphasised Dr. Jadesola Idowu, Chief Operating Officer, AXA Mansard Health Limited. She further highlighted the importance of adopting a bottom-up approach to ensure the effectiveness of health insurance for all Nigerians.

In the implementation of the NHIA Act, it is critical to recognise that states also have significant responsibilities and must be actively involved. According to Dr Jonathan Eke, General Manager, Formal Sector Department, NHIA, state governments play a vital role in ensuring the successful implementation of health insurance systems and effective functioning at the subnational level.

Exploring Innovative Health Financing Mechanisms for the Vulnerable Group Fund

During the third and final panel discussion, panellists explored utilising the Vulnerable Group Fund effectively, discussing innovative health financing mechanisms that maximise its impact and sustainability. Professor Olumide Ayodele, Senior Technical Adviser to the Director General, Budget Office of the Federation, highlighted the crucial role the government must play in financing health insurance as a starting point.

According to Professor Ayodele, mandatory health insurance places the responsibility on governments to allocate funding for healthcare. To enhance health coverage for the Vulnerable Group Fund, he stressed the need for more effective engagement with all stakeholders. According to him, this collaborative approach would facilitate improvements in healthcare accessibility and ensure the fund’s successful implementation.

“However, to effectively target the vulnerable population and address the barriers they face, such as limited access to financial resources, it is imperative that we prioritise providing them with access to existing programs specifically designed to enhance their health outcomes,” said Felix Obi, Associate Programme Director, Results for Development (R4D). This approach underscores the importance of understanding and addressing the unique challenges faced by vulnerable individuals, and ensuring they have equitable access to healthcare initiatives tailored to their needs.

Some key takeaways and recommendations from the 2023 Health Financing Consultative Forum are:

- Accelerate the implementation of the National Health Insurance Authority Act to address challenges and improve coverage rates for all Nigerians.

- Ensure the inclusion of persons with disabilities in health insurance through collaboration, policy adjustments, and tailored services involving disability organisations, policymakers, healthcare providers, and insurers.

- Prioritise collaboration and coordination among stakeholders, including government, insurers, healthcare providers, civil society organisations, and communities.

- States should implement the Health Insurance Authority Act by aligning policies, establishing state health insurance agencies, allocating resources, improving healthcare infrastructure, and engaging stakeholders to address local challenges.

- Foster close collaboration and information sharing among stakeholders involved in health insurance coverage.

- Explore innovative health financing mechanisms for the Vulnerable Group Fund through alternative funding sources, efficient fund allocation and utilisation, stakeholder collaboration, and transparent monitoring and evaluation systems.

- Prioritise increasing awareness of health insurance coverage through sensitisation efforts, town hall meetings, public service announcements, and engagement in local languages at the grassroots level.

- Encourage support from organisations outside the health sector, such as financial organisations, to bolster health financing efforts.

- Domestic resource mobilisation, value for money, transparency, and accountability in healthcare financing should be prioritised.

- Enhance the robustness of data gathering and analysis systems, while concurrently harmonising databases, to facilitate seamless integration and ensure effective monitoring.