Toluwani Oluwatola (Guest Writer)

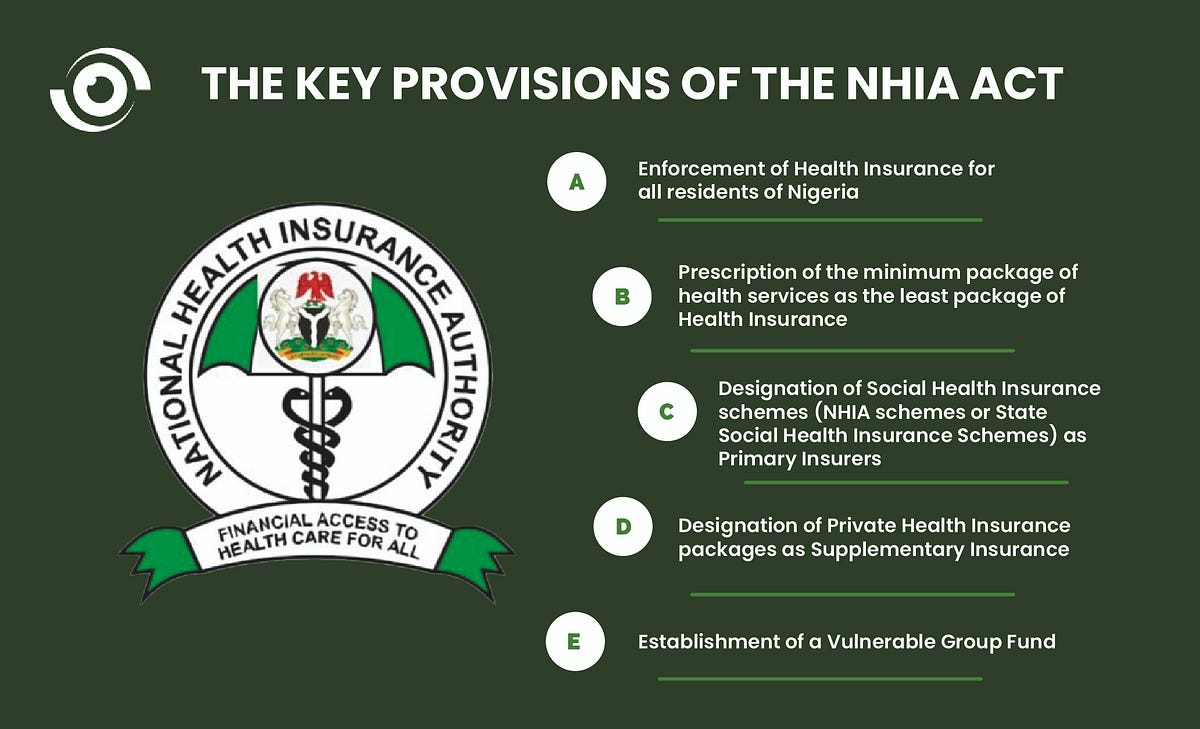

Nigeria’s quest for Universal Health Coverage (UHC) took a significant step forward on the 19th May, 2022, when former President Mohammadu Buhari signed the National Health Insurance Authority Act into law. This milestone was followed by the flurry of events, dialogue sessions and opinion editorials discussing how this new act would transform health financing and payment for healthcare services in Nigeria.

The implementation of the new act commenced immediately, marking the transformation of the National Health Insurance Scheme (NHIS) into the National Health Insurance Authority (NHIA). In addition, the designation of the Executive Secretary of the former NHIS was changed to the Director General of the NHIA.

In 2023, the Authority rolled out an operational guideline that would guide its operations in accordance with the new act. Despite these steps, the implementation of the new act has not maintained the initial momentum it generated within Nigeria’s public health community.

According to a survey by NOIPolls, 80% of adults in Nigeria pay for their health out-of-pocket, and only 17% have health insurance coverage. This indicates a very high financial barrier to healthcare services for the population. Like many low- or middle-Income countries (LMICs), Nigeria has adopted health insurance as its pathway toward universal health coverage, aiming to ensure everyone has access to affordable healthcare without financial hardship. Currently, there are multiple health insurance schemes operating in the country, including national and state health insurance schemes, as well as various private health insurance and microinsurance schemes. The NHIA Act of 2022 was passed at an opportune time to guide the provision and regulation of health insurance in the country and ensure its alignment with broader health system outcomes.

The NHIA Act of 2022 represents a model of how health insurance should function in Nigeria. However, the realisation of the Act’s full provisions will be quite challenging, requiring significant time and financial investments. Two years after its passage, it is important to focus on implementing the provisions of this Act that can yield timely wins on the country’s journey to UHC.

Here are three areas to consider:

1. Enforcement of health insurance in the formal sector: Nigeria, like many LMICs, has a very large informal sector, which makes the enforcement of social protection programmes, including health insurance, quite difficult. While enforcement in the entire population is desirable, it does not seem feasible at the moment. However, the enforcement of social protection programmes is easier within the formal sector.

However, current health insurance coverage falls short of the size of the formal sector indicating significant non-compliance, especially within the private formal sector. To enforce the provision of health insurance, the government could link employee health insurance benefits to public procurement by the private sector. Additionally, the authority could explore multi-sectoral partnership by establishing a joint enforcement committee with the Pension Commission (PENCOM), which also seeks to enforce the Pension Act. This joint enforcement would reduce the cost of enforcement and ensure the NHIA can leverage PENCOM’s experience in enforcing social protection.

2. Enforcement of the Minimum Package of Health Services: All health insurance schemes aim to achieve financial protection, and designating what should be covered to guarantee this financial protection is a fundamental duty of the regulator as prescribed by the Act. However, till date, different social health insurers sell varying products that differ in coverage and cost from the basic minimum package of healthcare services prescribed by the NHIA through the BHCPF guideline. Enforcing the harmonisation of benefits across different health insurance schemes would ensure equity in the purchasing power of health insurance products in the country.

3. Operationalisation of the Vulnerable Group Fund (VGF): The NHIA Act of 2022 expanded the scope of financial protection for indigent Nigerians beyond the Basic Health Care Provision Fund (BHCPF). There is an urgent need to expedite the operationalisation of this fund in line with the federal government’s sector-wide approach and to expand funding sources for poor and vulnerable Nigerians beyond the BHCPF. This is crucial to providing insurance coverage for Nigerians living below the poverty line.

The passage of the NHIA Act was momentous in the history of health bills in Nigeria due to its rapid turnaround time. However, the implementation of its provisions needs to be expedited, given its critical role in reducing Nigeria’s high out-of-pocket healthcare expenditure and achieving Universal Health Coverage. Delays and slowdowns in implementation come at a high cost, resulting in disabilities and loss of lives due to the inability to afford healthcare. This cost does not have to increase, the time for expedited action is now.

Toluwani Oluwatola is a public health practitioner and management consultant with interests in the financing and organisation of healthcare services in Nigeria.